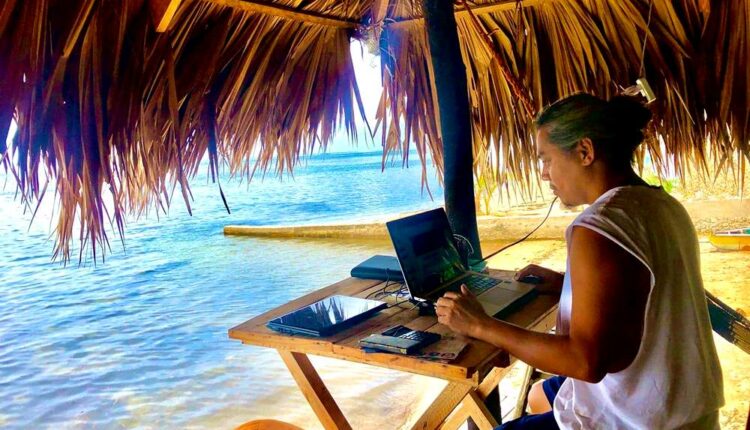

This is in light of recent government measures done to attract remote workers

With governments scrambling to welcome the surging number of digital nomads into Asia, it shouldn’t be a surprise that the rental real estate sector is experiencing significant growth of late.

Over the past year, initiatives such as Thailand’s Destination Thailand Visa, South Korea’s Workation Visa, and Malaysia’s DE Rantau Nomad Pass have helped redefine the concept of remote work whilst boosting the real estate sector in those specific nations.

According to C9 Hotelworks managing director Bill Barnett: “Asia is rewriting the rulebook to attract a new kind of global citizen: digital nomads who want flexible visas, affordable rentals, and community-driven spaces. It is a race to build policies and places that match their lifestyle.”

It should be noted at this point, however, that the influx has also made the rental real estate sector significantly more competitive, and the competition is just heating up.

The game-changer

While the total number of digital nomads in Asia remains unclear to this day, research group Pumble puts the global digital nomad population at around 40 million, 37 percent of which are of the millennial generation.

The immense surge of inbound digital nomads to the region has driven up demand in key markets throughout the Asian real estate sector, particularly in highly sought-after destinations like Bali, Phuket, and Boracay.

Furnished rentals are rapidly becoming a prop and mainstay of local communities, particularly on popular resort islands, as these are seen as safe havens for those seeking a refuge from an increasingly chaotic world.

That said, many developers are ramping up their rentals, but are also pushing the concept of co-living and community-centric living.

Indeed, within the Asia Pacific, growth for the co-living sector may grow at a compound annual growth rate (CAGR) of 17.9 percent within this year.

It should be noted, though, that facilities and amenities at co-living areas may vary depending on the country.

For example, many Thai co-living spaces integrate coworking areas, offer communal kitchens, and boast of sustainability measures like solar panels and waste management systems.

In the Thai co-living model, the design is meant to encourage community engagement, as well as staying for the long-term.

On the other hand, Japanese and Singaporean co-living spaces are a paradigm shift when it comes to urban living.

Consider CapitaLand’s lyf properties: these shared residences pair short-term leases with numerous engaging amenities, including bike-sharing areas, communal kitchen, and gardens.

As lyf managing partner Adeline Phu puts it: “We aim to be the community hub in every location we’re in, integrating our guests into the fabric of local life.”

The downside

As with everything, however, there is also a downside to this increased demand.

While the surge is making rental pricing more competitive in the region, it also poses an issue for locals looking for their own places to call home as these prices could be more “foreigner-friendly” and well over the usual citizen’s budget.

More foreigners in an area, as seen in many cases of overtourism throughout Asia, also have an adverse impact on supplies and basic commodities; the price of food and other necessities may be driven up considerably.

Digital nomads also pose a conundrum for governments, particularly immigration officials who can never be too sure if these are legitimate travellers or already engaged in illegal activity under the guise of remote work.

The stress on local infrastructure and the environment also needs to be taken into consideration at this point.

However, experts point out that, as the number of digital nomads increases over time, there will be a marked shift to outlying areas and less popular destinations, thus bringing a balance to the sector.