The ABTA Travel Trends 2026 report reveals behavioural shifts among UK travellers that directly influence Asia-Pacific tourism trends 2026, shaping demand for long-haul travel, cruise growth and new traveller profiles.

The ABTA “Travel Trends for 2026” report offers valuable insight into shifting traveller behaviour among UK consumers, one of the most essential long-haul source markets for the Asia-Pacific region. While the report is based on UK outbound travel intentions, the findings provide a strong indication of how Asia-Pacific tourism trends 2026 will evolve, especially for destinations seeking to strengthen long-haul arrivals, diversify seasonality and target high-spending traveller segments.

Long-haul demand strengthens Asia-Pacific’s competitive position

ABTA, Association of British Travel Agents, signals a renewed appetite for “The Longest Haul”, with more travellers willing to spend on long-distance journeys. According to the report, Australia, New Zealand and the Pacific Islands increased their share of UK travellers from 7% to 10% over one year, indicating a rising preference for far-flung destinations. This behavioural shift is crucial for the Asia-Pacific, as it demonstrates:

- A sustained demand for long-haul travel despite global cost pressures.

- An apparent willingness among travellers to trade higher flight costs for lower on-ground prices and favourable exchange rates.

- Strong destination awareness for remote regions where nature, wellness and immersive cultural experiences dominate.

This trend supports Asia-Pacific destinations such as Thailand, Indonesia, Vietnam, the Philippines, Japan and South Korea, all of which compete directly for the same long-haul traveller mindset defined by ABTA.

25–34-year-olds emerge as the most influential segment for the Asia-Pacific

One of ABTA’s most significant findings is the emergence of the 25–34 demographic as the “Travel Trendsetters”. The age group demonstrates the strongest long-haul travel intent and the highest projected spending. The report highlights: :contentReference[oaicite:2]{index=2}

- 83% consider holidays the most important time of the year.

- 90% prioritise holidays for mental health and wellbeing.

- 49% plan to spend more on travel in 2026.

- 84% expect to travel overseas within the next 12 months.

For Asia-Pacific, this group represents an ideal match:

- They prefer beach, adventure, culture and gastronomy – all pillars of APAC tourism.

- They engage heavily with wellness, “slow travel”, remote working and digital nomad experiences.

- They are highly influenced by online content, partnerships, and authentic, experience-driven itineraries.

Destinations in Southeast Asia, Japan and Australia can capture this segment through curated multi-experience journeys, wellbeing-focused offerings and flexible itineraries aligned with their lifestyle preferences.

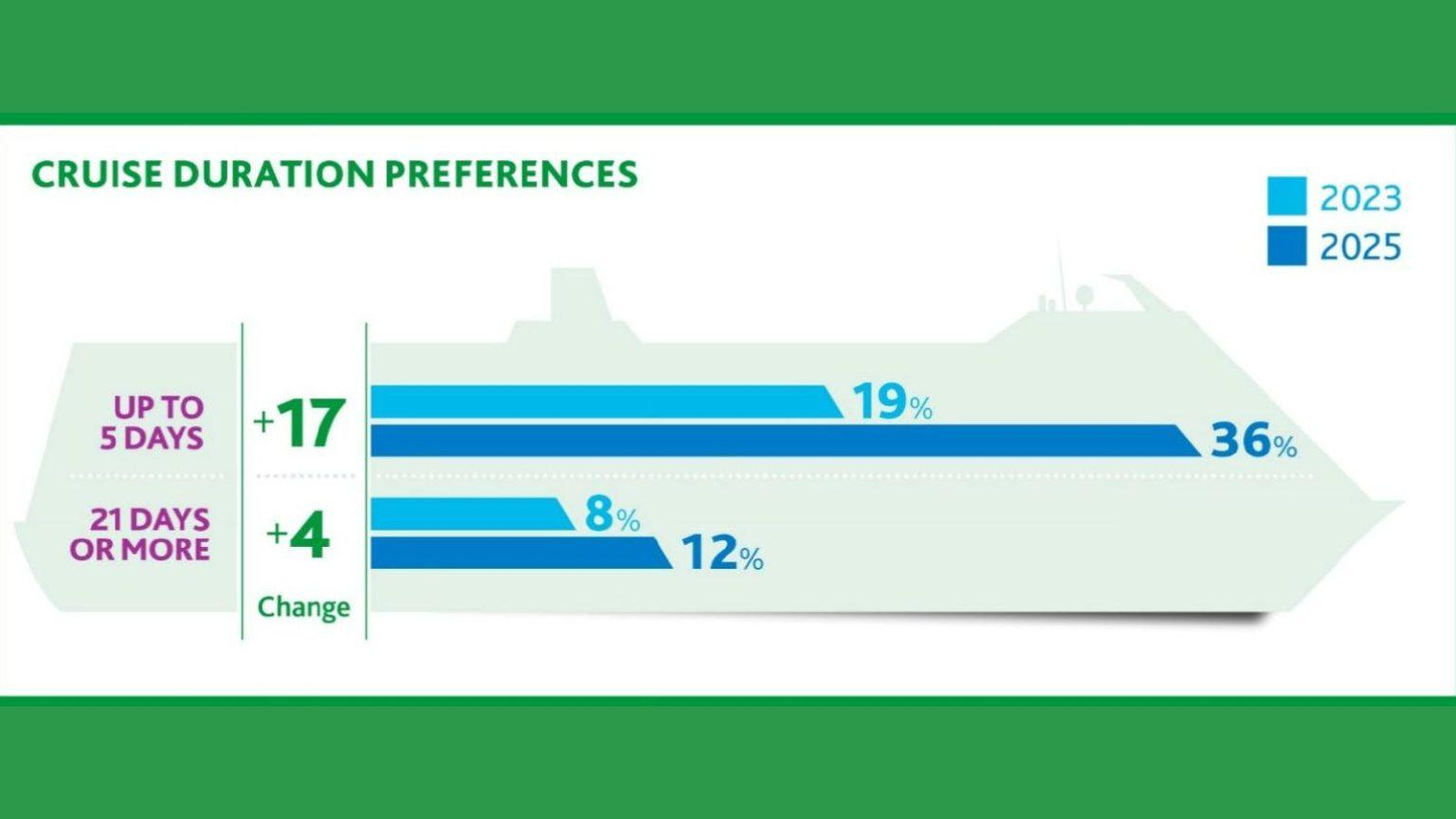

Rising interest in shorter cruises supports Asia-Pacific’s cruise expansion

ABTA reports strong growth in short cruises (up to 5 days), particularly among younger age groups. Interest in these itineraries rose from 19% to 36% between 2023 and 2025, with 57% of 18–34-year-olds considering them. :contentReference[oaicite:

This trend supports Asia-Pacific’s developing cruise hubs:

- Singapore is a major homeport for short regional cruises.

- Hong Kong’s increasing investment in multi-stop cruise tourism.

- Emerging port development in Thailand, Vietnam, Indonesia and the Philippines.

Shorter itineraries align well with the Asia-Pacific cruise model, which is currently dominated by 3–7 day regional loops – an increasingly attractive proposition for long-haul travellers extending a holiday beyond a land-based stay.

Younger travellers drive interest in multi-country, flexible land travel

ABTA notes a steep rise in rail and multi-stop overland exploration among 18–24-year-olds, who more than doubled their rail/interrail trips from 5% to 12% within three years. :contentReference[oaicite:

While Asia-Pacific lacks the integrated rail networks of Europe, this shift highlights a mindset supportive of:

- slow, immersive travel

- multi-country itineraries within a single region

- experiences centred on sustainability, culture and local communities

Destinations such as Japan, South Korea, Vietnam, Thailand and Malaysia can benefit by promoting rail tourism, heritage routes, soft-adventure and meaningful travel themes increasingly prioritised by Gen Z and young millennials.

High-season diversification offers an opportunity for Asia-Pacific.

ABTA’s “Super September” trend confirms a shift away from traditional peak-season travel toward late-summer and shoulder-season mobility. As 24% of UK travellers plan to holiday in September, the most popular month, Asia-Pacific destinations benefit indirectly:

- Australasia and Southeast Asia can position September–November as premium periods for long-haul travel.

- Monsoon transition periods can be reframed with themed products, indoor activities and wellness packages.

This aligns with demand for value-driven travel outside peak holiday pricing cycles.

Strategic takeaways for Asia-Pacific tourism stakeholders

Based on the ABTA findings, several implications emerge for the Asia-Pacific tourism trends 2026 landscape:

- Long-haul demand is resilient: APAC destinations should strengthen UK market campaigns.

- High-spending 25–34-year-olds must be a central marketing priority.

- Wellness, cultural depth and adventure experiences align perfectly with traveller expectations.

- Short cruises represent a fast-growing opportunity for regional hubs.

- Flexible, multi-stop travel products appeal strongly to Gen Z and younger millennials.

The ABTA Travel Trends 2026 report demonstrates that the UK market is entering a period of higher spending, stronger long-haul intention and greater demand for meaningful, experience-driven travel. These shifts place the Asia-Pacific in a highly advantageous position. By adapting product development, strengthening experiential offerings and targeting emerging traveller segments, destinations across the region can capture substantial growth from the evolving UK outbound market throughout 2026 and beyond.